Money Management Tips for Couples: Three Ways to Split the Bills

All couples fight, but fights about money are one of the biggest predictors of divorce. It’s not sex, in-laws, parenting or dirty towels. Money disagreements are a major threat to your relationship.

A 2013 study tracked 4,500 couples and found that couples who fought about money early in the marriage experienced low relationship satisfaction. The biggest issue with money is that both members of a couple come to the marriage with their own sets of assumptions and expectations about money.

Money is also one of the biggest taboos in our society. A survey by Wells Fargo found that 44% of Americans find personal finance the most challenging topic to discuss with others. People are less likely to talk about money than they are to chat about politics, religion or death!

This discomfort with money extends to our close relationships, too. Forty percent of couples say they didn’t discuss personal finances before getting married!

Even though we, as a society, are uncomfortable talking about money, it’s an incredibly important topic to talk about regularly with your partner. In fact, your very relationship may depend on having that tough conversation!

Why do couples fight about money?

Couples don’t just fight about one partner’s spending habits. There are plenty of other issues that can catch couples off-guard when it comes to money.

Spending vs Saving

You and your spouse might have very different views of what percentage of income you should spend and how much to save. One of you might be comfortable spending your entire earnings, while the other might want to save 30% of your income.

Spending all of your income isn’t uncommon: 20% of working Americans don’t save at all. It can be hard to put away some of your hard-earned money into a retirement or savings account that you won’t need for years.

Saving vs spending is a money fight that will come up again and again because it affects almost every aspect if your life – if you allow it to do so.

One Partner Earns More

When one partner earns more, it can be tough on a marriage. An income imbalance can lead to guilt, power struggles and resentment. At some point, you may face extreme differences in income when one partner decides to stay at home or go back to school. Even if you are both working, different industries, career paths and skill sets mean that you probably won’t make exactly the same amount.

Debt from Single Life

If you went to college or lived on your own before marriage, you’re probably coming into the relationship with some dept. About 69% of 2018 college grads had student loans and Americans owe $1.56 trillion in student loan debt.

Even if you and your partner avoided student loans, you might be one of the 44% of American households that have credit card debt. If partners come into a marriage with different amounts of debt, there can be disagreements over how to pay off the debt. This is especially true when the debt was accrued prior to the relationship.

How do Couples Split Finances?

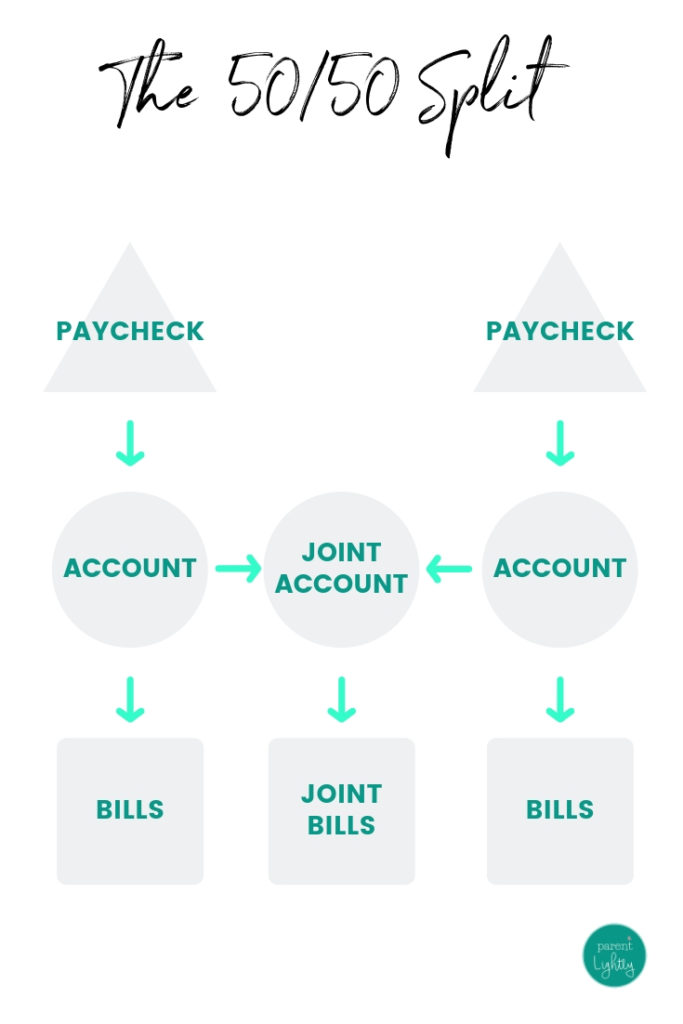

Method 1: The 50/50 Split

If you want to keep it even, you can split your expenses 50/50. Typically, each partner would keep a separate account and then contribute to 50% of the household bills. The joint bills could be paid either from a third joint account or each individual could pay half.

The flow of money would look like this:

Benefits of the 50/50 Approach

- Each partner maintains some financial autonomy since they can use whatever is left of their paycheck as they see fit

- In theory, one partner isn’t responsible for the other partner’s overspending (unless they’re married.)

- This approach accommodates different spending styles. If one partner likes to spend and the other partner likes to save, in theory each can do that with what is left over after they pay their share of the joint bills.

- Because each partner maintains a separate account, there’s little to no “oversight”. Your partner isn’t wondering why you spent $100 on moisturizer and you’re not rolling your eyes at yet another video game purchase.

Drawbacks of the 50/50 Approach

- If income isn’t 50/50, this approach can create major resentment. Who wants to pay half of the household expenses when they make only half what their partner does?

- You have to agree on what is considered a “joint” expense, including things like dinners out, groceries, gym memberships, etc.

- Once you define a joint expense, you also have to track it. Rent and utilities are easy – it’s the variable expenses that are challenging.

- Balancing the accounts can become annoying if you pay bills out of individual accounts rather than creating a third joint account.

Who is the 50/50 Approach best for?

The 50/50 approach can work well for couples who have similar income levels but aren’t ready to combine their finances. This could be for any number of reasons – you have different approaches to spending and saving, one of you is paying off debt or you want to maintain control over your own finances.

Best Practices for the 50/50 Approach

- Put all joint expenses on one credit card and all individual expenses on another. This makes it easy to sort out at the end of the month.

- Definitely create a third joint checking account. Contribute the designated amount each month to the joint account from your individual account.

- Pay all joint bills from the joint account.

- Set some savings goals as a couple so “savers” can rest assured that their “spender” partners are saving at least a little bit.

- Be inclusive on what constitutes a joint expense. When we did this, meals we ate together, gym memberships and all groceries were considered joint.

Method 1 Variant: The Uneven Split

One of the main drawbacks of splitting expenses 50/50 is that it seems unfair if you make less than your partner. That’s why we split household expenses according to our income when we used this method of money management.

At the time, I think I made 40% of our total income and my husband made 60% (roughly). So I paid 40% of the household expenses and he paid 60%. This made the whole thing seem more fair.

I would pay less of the joint expenses and therefore have roughly the same percent of my paycheck left in my individual account.

The pros and cons are otherwise similar to the 50/50 split method.

Who is the Uneven Split Approach best for?

The Uneven Split approach is perfect for couples who want to maintain control over their own finances but have unequal incomes. This approach reduces resentment by splitting household expenses according to income. Members of the couple still handle the rest of their financial decisions – paying off debt, saving, investing and spending.

Best Practices for the Uneven Split

- Think about how to handle splurges. If you make more than your partner, you might want to take an expensive vacation that your partner can’t afford. Should you pay for the whole thing? Ask your partner how much he can contribute? It’s something to discuss.

- Also discuss how you’ll approach the uneven amount of individual spending money. Will the partner with a lower salary feel resentful that the other has more disposable income? Only you know yourself well enough to predict whether this will be a problem for the relationship.

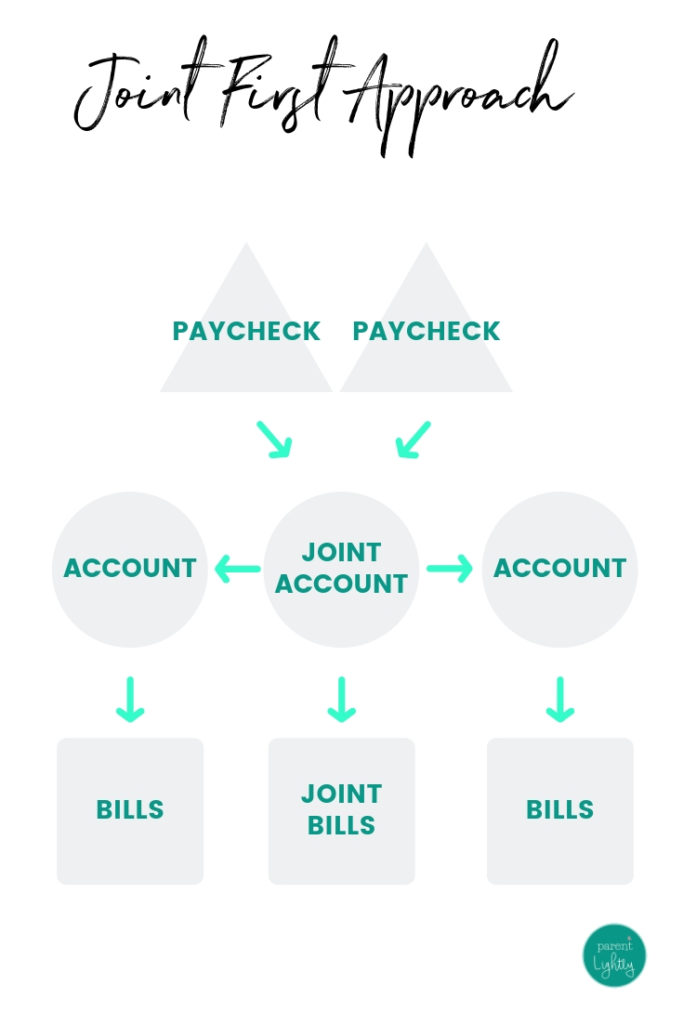

Method 2: Joint First Approach

Using this method, all paychecks will initially go into a joint account. From there, a set amount each month will be transferred to individual accounts to cover individual expenditures.

You’ll have to consider what is “joint” and what is “individual.” The more that’s identified as an individual expense, the more money should go to the individual accounts each month.

Benefits of the Joint First Approach

- If there is an income gap, the joint first approach allows you to even out the amount that each individual gets per month. .

- Partners still maintain autonomy on their individual purchases. There’s less oversight because you’ve agreed on the individual budgets in advance.

- Because the joint account is paid first, there’s less possibility that you won’t be able to cover joint bills.

Drawbacks of the Joint First Approach

- You have to define what is joint and what is individual, and find a way to track each.

- You’ll need to agree as a couple on how much should go to each individual account.

- The higher earning partner may feel resentful that they don’t get to spend in proportion their earnings.

- There’s still a need to track multiple expenditures and pay bills from multiple accounts.

Who is the Joint First Approach best for?

The Joint First approach can work well for couples who have similar financial goals but different ideas about individual spending. If you want the ease of combining finances but struggle with scrutinizing your partner’s purchases, this is a good solution. This approach works well whether a couple has income disparity or not. The main thing is that you have to be able to agree on how much money each individual gets and how to save, invest or spend the remainder. I consider this a stepping stone to full merged finances.

Best Practices on the Joint First Approach

- We preferred to keep the individual budgets as truly ‘fun’ money, separate from necessary items like gas, basic clothes, and food.

- All necessities like groceries were paid out of the joint budget, even if it was one individual purchasing.

- Don’t pay attention to how your partner spend his individual money as long as he stays in budget.

- Like the Split approach, use different cards to pay for joint vs individual expenses so they are easily tracked and paid.

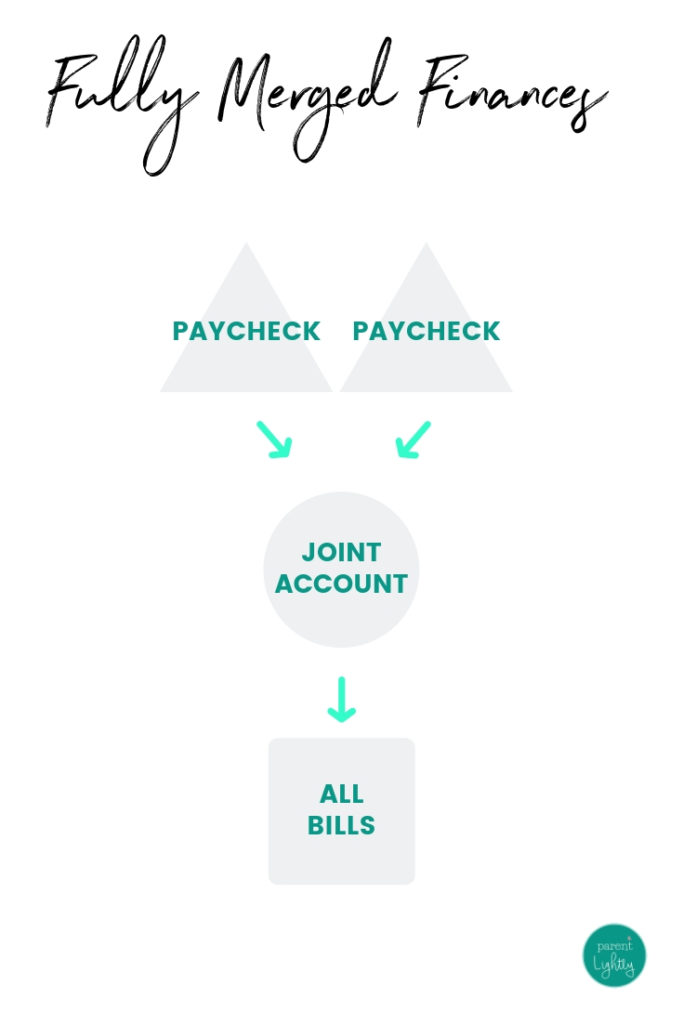

Method 3: Fully Merged

In the fully merged method, your finances are completely joint. There is just one bank account from which all expenses are paid. You’re no longer sending any money to individual accounts.

This approach is much easier than the other two because you’re not dealing with multiple accounts and multiple categories of spending. It’s best when the couple has similar-enough spending styles and each partner the other.

Because this method doesn’t explicitly cap or track individual expenditures, it does require both members of the couple to exercise some restraint if they have spender tendencies. It can work well when income is relatively equal or when the income disparity is large.

The biggest benefit if this approach is that it’s streamlined and simple. It’s easy to see how much you’re spending because it’s all coming and going from the same place.

Benefits of the Fully Merged Approach

- Simple to manage because there are fewer accounts

- Easy to see how much money you have and what you are spending on because the system is simple

- May help spenders reign in their spending habits (because their partner can see what they’re buying!)

Drawbacks of the Fully Merged Approach

- Lack of autonomy in individual purchases- may feel scrutinized

- If one partner does not budget well, both peoples’ finances can be adversely affected

- If both people own the joint account, things can slip through the cracks

Who is the Fully Merged Approach best for?

Couples can fully merge their finances when they’re on the same page about financial decisions. If you and your partner have ground rules on saving, spending and investing then you are ready to merge your finances.

Best Practices for the Fully Merged Approach

- Agree on a dollar amount that requires a discussion with your partner. For example, if I want to buy a $500 chair, I’ll talk with my husband before I buy it. A $100 pair of pants does not require a discussion. Decide on your threshold based on your income and relative frugality.

- Designate an owner. Someone must ultimately own paying the bills and tracking the budget. If both people own it, no one will actually own it. So pick someone.

- If one of you is anxious about finances, set a budget. This will really free you from nitpicking because, hey, if it’s in the budget it’s all good. Numbers are so much less emotional than people.

Money Management Tips for Couples

There are so many different ways to handle joint financial decisions. The best one for you really depends on your income levels and temperaments. Don’t be afraid to switch things up if you find that one method isn’t working for you. Remember – this isn’t about right or wrong – it’s about working with your innate tendencies and those of your partner.